5 min read

Washington Paid Leave: What Businesses Need to Know

Employees in Washington have access to paid family leave under the Washington Paid Family and Medical Leave Act (WA PFMLA). As such, employers must...

3 min read

PayNW : May 13, 2020 9:00:00 PM

-1.png)

UPDATE: Immediately following the posting of this blog post, the Seattle Times published this breaking news update:

Washington to pause unemployment payments after finding $1.6 million in suspected fraudulent claims

Washington state officials say they’re pausing unemployment payments for two days while they attempt to block a gush of fraudulent claims aimed at stealing some of the billions that Congress directed to workers left jobless amid the coronavirus pandemic. The surge in fraudulent claims comes as the state is trying to process a massive wave of legitimate claims for jobless benefits.

_____________________________________________________

Recently, unemployment fraud has spiked amidst this COVID-induced economic downturn. Fraudsters are creating state accounts using previously stolen social security numbers and residency addresses to file for state unemployment. In Washington State we have been made aware by several of our clients that they have received notices of claims filed by employees who are still working for them and did not in fact file for unemployment.

So, what can be done? For employers, it is a fairly straightforward matter of responding to the claim paperwork indicating that the employee was not, in fact, terminated. This is a hassle and needless paperwork during a time when a lot is being placed on employers’ shoulders, but is straightforward enough.

For employees, it is recommended that each employee set up their account at their state unemployment office (for Washington state this is a SAW account and can be done here). This will prevent a fraudster from using an employee’s information to set up a bogus account since only one account may be set up per social security number.

For employees who have had their personal information already used and abused, the recommended response is a little more daunting, though important.

For employees in Washington, Seattle Police Department cyber-crime investigators are recommending the following steps for anyone who knows, or believes, they are a victim of unemployment fraud:

This is one more challenge to hit employers and employees during this difficult time. Prompt action and some persistence on the part of all can help shut down this latest scheme to defraud states and the federal government of unemployment funds meant to help those truly out of work.

5 min read

Employees in Washington have access to paid family leave under the Washington Paid Family and Medical Leave Act (WA PFMLA). As such, employers must...

1 min read

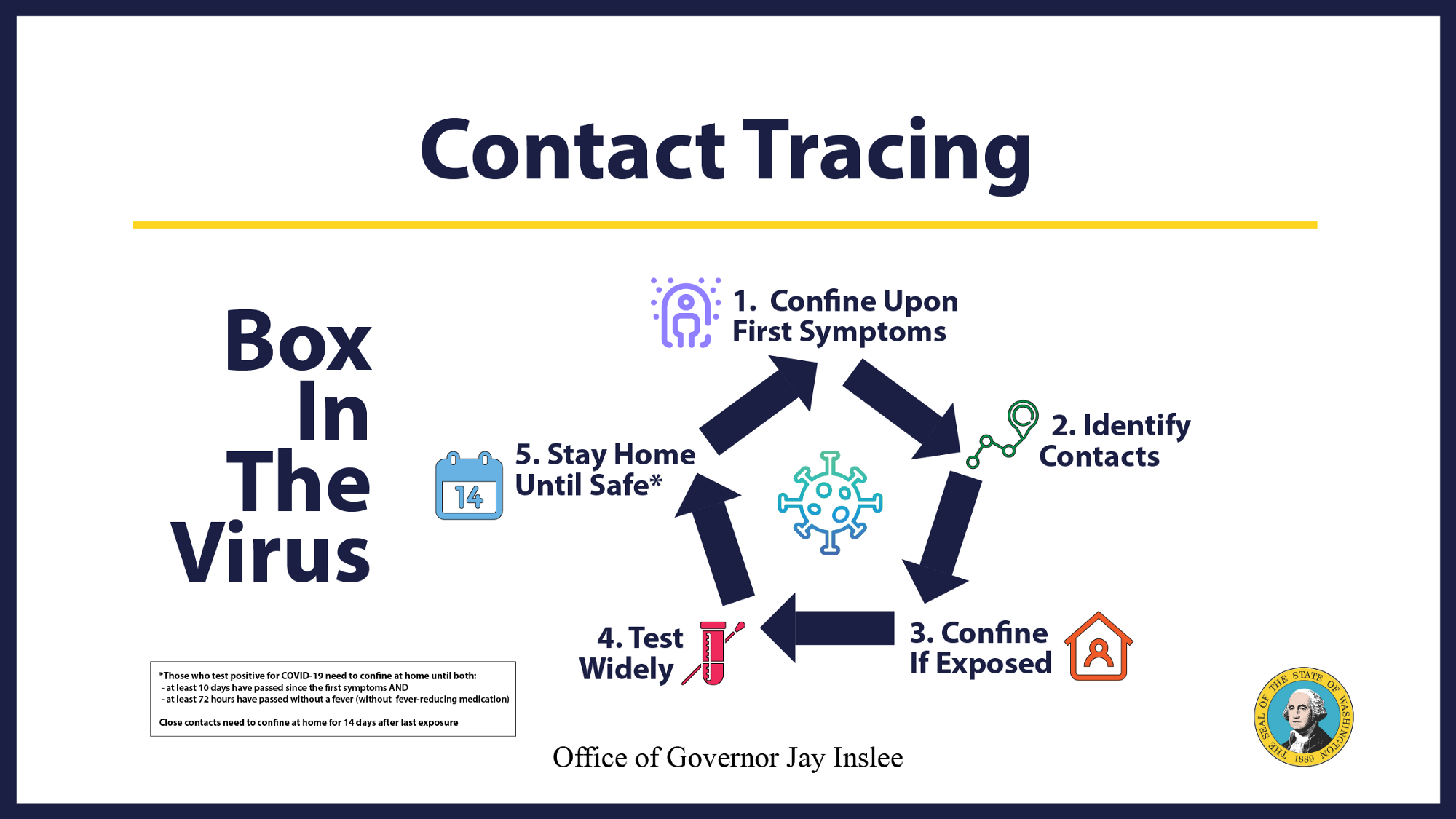

On May 12, Washington Governor Jay Inslee announced a plan that will allow more businesses to open and more people to be active in public while still...

Employers are encouraged to develop a Safe Work Plan in order to resume operations as public health prerequisites are met. As part of “Safe Start...