3 min read

Paperless Payroll: Benefits of Electronic Pay

Is your company still clinging to the outdated practice of paper checks? Businesses should consider joining the growing number of organizations...

2 min read

PayNW : Jul 13, 2023 9:53:39 AM

In this digital age, businesses face a growing threat known as employee spoofing, where malicious individuals compromise employee information to deceive organizations into making unauthorized payments or changing direct deposit details.

Here is what you need to know to protect your business from things such as Direct Deposit Fraud and other types of employee spoofing and payroll fraud.

To ensure the safety of your business and employees, it is crucial to remain vigilant and take proactive measures, as allowing a direct deposit scam is one of the biggest payroll mistakes you can make.

This article aims to educate clients on how to identify and prevent direct deposit fraud while highlighting the importance of voice verification when handling direct deposit changes.

Direct Deposit Fraud, a type of employee spoofing, occurs when cybercriminals gain unauthorized access to employee information and attempt to deceive businesses.

These fraudsters may impersonate employees or clients using various methods, such as email or other electronic communications. By imitating legitimate requests, they manipulate organizations into processing fraudulent payments or modifying direct deposit instructions.

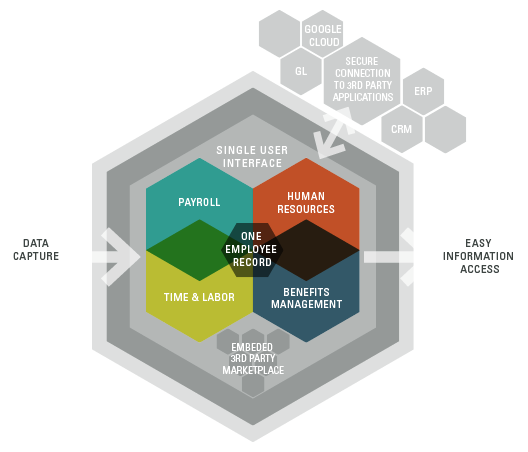

The reduced risk of fraud and employee spoofing is just one of the many benefits of a cloud-based payroll solution.

To protect your business from employee spoofing, it is important to be aware of the warning signs.

Here are some indicators that can help you identify Direct Deposit Fraud and employee spoofing attempts:

While one of the best methods of preventing direct deposit fraud is with a modern payroll solution, there are some additional steps you can take to protect your business.

To bolster your defenses against employee spoofing, consider implementing the following preventive measures:

Educate your employees about the risks of employee spoofing and the importance of safeguarding personal information. Encourage them to be vigilant and report any suspicious activity immediately.

Establish and enforce strict protocols for validating direct deposit changes. Always require voice verification, especially if the request is not initiated by the employee themselves through the designated employee self-service portal.

Invest in comprehensive cybersecurity solutions to protect your systems and networks from unauthorized access. Regularly update software and firmware to ensure all vulnerabilities are patched.

Continuously assess and enhance your organization's policies and procedures to address emerging threats and stay ahead of evolving fraud tactics.

Employee spoofing and fraudulent direct deposit requests pose significant risks to businesses and their employees.

By understanding the signs of such fraudulent activities and implementing robust preventive measures, you can safeguard your organization against these threats.

Educating employees about the risks and promoting a culture of vigilance will contribute to the collective effort to combat employee spoofing.

Remember, always prioritize voice verification for direct deposit changes to ensure the authenticity of requests and protect your business from financial loss and reputational damage.

For more information on how to prevent these types of scams, contact us today.

Watch our payroll demo video below to learn more about how our payroll software can help keep you and your employees secure.

3 min read

Is your company still clinging to the outdated practice of paper checks? Businesses should consider joining the growing number of organizations...

1 min read

To ensure the proper payroll and Human Resources (HR) system is in place for your organization, you first need to evaluate both your business needs...

3 min read

When it comes to managing your business’s HR and payroll needs, it’s essential to understand the different options available. Two popular choices are...