Table of Contents

Year-End Guide 2025

Here to make your life easier during year end

Secure 2.0 Act: Catch-Up Contributions Must Be Roth (Effective 1/1/2026)

Important update: The IRS updated the wage threshold from $145k to $150k for 2025. (IRS Notice)

What’s Changing

Employees who are age 50 or older can make extra catch-up contributions to their retirement plan on top of the regular annual deferral limit.

-

In the past, participants could choose whether those catch-ups were pre-tax or Roth (post-tax).

-

Beginning January 1, 2026, that choice changes for certain higher-earning employees.

New Requirement

Starting in 2026, if an employee earned more than $150,000 (this amount will adjust annually for inflation) in wages subject to Social Security tax (FICA) from the same employer in the prior calendar year, then all catch-up contributions for that year must be made as Roth (after-tax).

If the employee earned $150,000 or less in FICA wages from that employer last year, they may continue to choose pre-tax or Roth for their catch-up contributions.

Example

-

An employee who earned $160,000 in 2025 from your company and is 50 or older in 2026 → their 2026 catch-up contributions must be Roth (after-tax).

-

An employee who earned $100,000 in 2025 → can still decide whether to make their 2026 catch-up as pre-tax or Roth.

Key Points to Know

-

The $150,000 threshold applies per employer, based on FICA wages from the prior year only.

-

The rule affects catch-up contributions (the amount allowed for employees 50+), not regular 401(k)/403(b) deferrals.

-

If your plan does not currently offer a Roth option, you’ll need to add one by 2026 to keep allowing catch-up contributions for affected employees.

-

Regular contribution limits under Section 402(g) still apply as usual.

What Employers Need to Do Now

-

Coordinate with your retirement plan provider or advisor.

They can confirm whether your qualified plan currently allows Roth contributions and advise on any amendments needed before January 1, 2026. They can also guide you on how to communicate this change to employees who will be affected.Don’t have a plan provider or wish to talk with someone new? PayNW has partnered with Human Interest to help our clients with their retirement plan needs.

-

Confirm whether your plan will support Roth catch-up contributions in 2026.

The new rule requires Roth catch-up for certain employees. If your plan does not offer Roth today, you will need to work with your plan provider to add it. -

Identify which employees may be affected.

Any employee who earned more than $150,000 (indexed) in FICA wages from your company in 2025 and who is age 50 or older in 2026 will have mandatory Roth catch-up treatment. -

Prepare employee communication.

Once you confirm Roth availability in your plan, share upcoming changes with impacted employees so they understand how their catch-up contributions will be handled in 2026. -

Complete PayNW’s required form.

After confirming Roth availability with your plan provider, fill out the PayNW form indicating whether your plan supports Roth catch-up contributions.

This allows us to update your system settings and ensure accurate payroll processing for 2026.

OBBBA – No Tax on Tips and Overtime

🔗Overview - review IRS guidance here

🔗Additional IRS Guidance released November 21, 2025

What qualifies for tax relief

Overtime

Only overtime that is required under the Fair Labor Standards Act for hours worked over 40 in a workweek qualifies. The amount eligible for tax relief is the premium portion that is above the employee’s regular rate of pay. This is the extra half-time paid when overtime is calculated at time and one half. Overtime paid under state law daily overtime rules, employer policy, or a collective bargaining agreement may not qualify unless it is also required under the federal FLSA. Additional IRS guidance is expected.

Tips

Tips must be cash or equivalent voluntary tips. This includes credit or debit card tips and tip-pool distributions received by employees working in occupations the IRS identifies as “customarily and regularly” receiving tips as of December 31, 2024.

Transition penalty relief for tax year 2025

What the relief covers

For 2025 only, employers and payors will not be penalized if they do not provide a separate accounting of cash tips or the occupation of the person receiving tips or separately report the total qualified overtime compensation. This relief applies only if the employer or payor still submits a complete and correct return, such as Forms W-2 or 1099.

Why the relief is in place

Payroll systems are not yet able to fully track or report the new information required under OBBBA. Forms W-2 and 1099 will not include new fields for 2025. The IRS is treating 2025 as a transition year to prepare for full implementation.

Encouraged, but not required, for 2025

Employers are encouraged to help employees claim their OBBBA deductions by providing occupation codes and separate tip totals and by reporting the qualified overtime premium separately. These details may be shared through online employee portals, separate written statements, other secure delivery methods, or Box 14 of Form W-2 for overtime information, which is optional for 2025.

Update for 2026

Overtime

Beginning in 2026, employers are required to separately report the overtime premium portion of pay on employee W-2s. The premium is the additional pay earned for overtime, not an employee’s regular wages.

What this means for your payroll

As an initial step in preparing for this requirement, PayNW is enabling a parallel FLSA weekly overtime calculation that tracks only the overtime premium portion for reporting purposes.

This applies to clients who use both payroll and time tracking, allowing overtime premiums to be identified based on weekly timesheet data. This change does not impact how overtime is calculated or paid.

As this is an early step toward 2026 reporting, the overtime premium amounts tracked may not reflect the full or final premium you expect. That is okay. We are actively working through overtime configurations and more complex overtime scenarios, and some setups may require clarification or adjustments as we prepare for accurate year-end reporting.

• Overtime pay is not changing

• Employee time entry is not changing

• Your payroll process is not changing

What you may notice

At this time, overtime premium amounts will not appear on employee pay statements. You may see a new memo earning code labeled “OBBBA Qualified OT Premium” in certain payroll reports. This memo earning code is used for reporting purposes only and can be filtered out as needed.

What if I do not use time tracking?

If you do not use PayNW time tracking, no changes are being made today.

We are actively working on solutions for other scenarios and will share more guidance as it becomes available.

Anything I need to do?

No action is required at this point.

PayNW will be reviewing overtime setups as this rolls out and will reach out if any questions or adjustments are needed. This message is intended to keep you informed as we begin preparing for 2026 reporting.

Tips

Beginning in 2026, employers are required to separately report qualified tips on employee W-2s. Qualified tips include tips received by employees in the course of their work that are subject to federal income tax reporting.

As long as qualified tips are reported when payroll is processed, PayNW will ensure they are included correctly for W-2 reporting. No additional setup or changes to your payroll process are required at this time.

This requirement does not change how tips are paid or how payroll is run. Our focus is on ensuring tip amounts already being reported flow accurately to year-end reporting as part of 2026 compliance.

Reminder of Standard Payroll Processing Schedule

As a reminder, the standard payroll processing schedule is to submit payroll to us by 1:30PM PT, at least 2 business banking days prior to your check date. Payrolls submitted later are subject to rush processing fees. Please reach out to your Service Representative at support@paynw.com with questions.

Holiday Delivery Times

PayNW exclusively uses next-day delivery via FedEx. If you are concerned about the time of day in which your payroll delivers, particularly with the holidays, consider processing a day early.

We also have Paycard options in lieu of issuing paper checks for employees. Email your Service Representative at support@paynw.com if interested in learning more.

.jpg?width=533&height=400&name=Stopwatch%20Over%20a%20Carton%20Boxes.%20Express%20Delivery%20Concept%20(400px).jpg)

Electronic W-2 / 1099 / 1095-C Delivery

For employers who have chosen to enable Electronic Consent, employees may choose to receive their W-2s / 1099s / 1095-Cs electronically, in lieu of a paper copy by December 26th. To offer this feature to your employees, have them follow these easy self-service steps within the PayNW portal.

Employees who provide Electronic Consent may view and print their documents directly with Self Service, just as they would their pay statement today. If an employee enabled Electronic Consent previously, this is how they will receive any of their future W2/1099/1095C. PayNW will print and mail W-2s / 1099s / 1095-Cs directly to employees who do not provide electronic consent no later than January 31st.

PayNW will be closed to observe all Federal Holidays in 2026.

- New Year's Day, January 1st

- Martin Luther King Day, January 19th

- President's Day, February 16th

- Memorial Day, May 25th

- Juneteenth, June 19th

- Independence Day, July 3rd

- Labor Day, September 7th

- Indigenous Peoples' Day, October 12th

- Veterans' Day, November 11th

- Thanksgiving Day, November 26th

- Christmas Day, December 25th

Payroll-Related Policy Changes

Alterations to company policies that will affect 2025 payrolls should be submitted to your Service Representative at support@paynw.com 3 weeks prior to payroll processing. This will give our team time to set up and test the changes.

Changes may include but are not limited to:

- Pay Frequencies

- Time off / accrual policies

- 401(k) plan changes

BENEFIT RENEWALS

We request you send us your benefits information a minimum of 30 days prior to your open enrollment start date. This allows us to complete the configuration changes timely. Late submissions may incur additional fees.

IMPORTANT

For clients subscribed to EverythingBenefits Carrier Connection, please note that late submissions of Open Enrollment dates and changes may incur increased fees. EverythingBenefits cannot guarantee timely execution for late submissions.

Review And Update All Employee-Related Information For Accuracy Including:

- Employee Social Security numbers, date of birth, and addresses

- Employee Name should be formatted to match their Social Security card

- Review/Update SOC codes assigned to employee profiles (for unemployment returns in AK, LA, SC, WA, and WV)

NOTE: Incorrect, Missing, or Invalid SSNs, missing SOC codes, and name formatting issues can cause errors with Federal and State tax returns for the employee and the employer. This can result in penalties and interests for the employer, along with fees associated with corrections and amended returns. (Use this SSA resource to help identify invalid SSNs)

Report Any Remaining 2025 Payroll-Related Information And/or Adjustments Including:

- In-house checks

- Voided checks

- Fringe benefits (S-Corp Insurance for owners, Personal Use of Company Car, Group Term Life in excess of $50K, etc.)

- Deferred Comp

- Short-term disability payments

Report Third-Party Sick Pay (Disability Payments)

Insurance companies must notify you of any disability benefits paid to your employees in 2025 by January 15, 2026.

If you’ve been notified, contact your Service Representative at support@paynw.com by December 26, 2025.

If you receive the notification after your last payroll of the year, reach out to your Service Representative ASAP.

Please inform your insurance company that we will include third-party sick pay on the W-2 Forms we prepare.

Tax Registration Services Available

At PayNW, we're experts in payroll tax registration. We're fast and efficient, ensuring that your new states are registered as quickly as possible so you can start paying payroll taxes in compliance with state regulations and have confidence knowing that your registration will be done correctly and on time.

We'll handle the entire process for you, from registration to setup to tax processing, so you can focus on what you do best: running your business.

Email our service team at support@paynw.com or contact us to learn more.

Important Note: Don't forget, PayNW is committed to delivering exceptional service to facilitate the registration of your tax accounts. But it's important to note that the responsibility for ensuring timely compliance with payroll tax regulation lies with your company. Completion and submission of requested documents in a timely fashion, is imperative to avoid potential filing delays and penalties. Please be sure to review and adhere to any agency mandated tax deadlines to avoid any potential penalties and interest charges.

UI And L&I Rate Change Notices

State Unemployment and state workers' comp programs, including Washington Labor and Industries (L&I), will mail 2025 rate change notices starting this month directly to your business. Some agencies will notify you to obtain it online if they are only available electronically. Please forward them to your Service Representative at support@paynw.com to ensure proper calculation of your 2025 payroll taxes.

States With Paid Family Leave

Paid Family and Medical Leave programs may also mail notices including eligibility status and premium changes for 2026. We need these letters to properly calculate your taxes and returns correctly in 2026. Please forward any notices to your Service Representative at support@paynw.com.

Missing State and Local Account IDs

PayNW has started emailing a report monthly with the last payroll of the month called “Applied For” to your Payroll Administrator. If you have any agencies that we still need the state or local ID number for, they will be listed on the attached report. Please be sure to provide us with these ID numbers no later than Friday, December 19th, 2025. Any ID numbers received after this date will not be filed in a timely manner by PayNW and may result in late filings and/or penalties.

Important: PayNW will not collect, pay, or file for agencies with missing ID numbers

Minnesota Paid Family Leave

- All Employers with 1 or more Minnesota employees (except for tribal nations, federal government employees, and self-employed)

- Employers with a count of 30 or less employees can qualify for a reduced small employer premium rate and an average employee wage that is less than 150% of the statewide average weekly wage

- All employers must pay at least 50% of the rate, while small employers will only pay 50% of the large employer rate. (0.44% for Large Employers and 0.22% for small employers for 2026. Employees will always pay 50% of the rate, 0.44% for 2026.) Employers may always opt to cover more or all of the withholding.

- Employee counts are based on the highest single wage detail report during the four-quarter period that ends September 30 of the prior year.

- Tax rate for 2026 is 0.88%

- More information is available at https://paidleave.mn.gov/

Connecticut Paid Sick Leave Updates

Starting January 1st, 2026 covered employers definition will update from 25 or more employees in CT to 11 or more employees in CT. This definition will update January 1st, 2027 to 1 or more employees. The number of employees is based on employer’s payroll for the week containing January 1st, annually.

Dependent Care Assistance (FSA)

New rates for 2026 and going forward will be:

- $7,500 for single or married couples filing jointly (previously $5,000)

- $3,750 for married couples filing separately (previously $2,500)

Social Security Wage Base Update

2026 Social Security will be $184,500, up $8,400 from $176,100 in 2025.

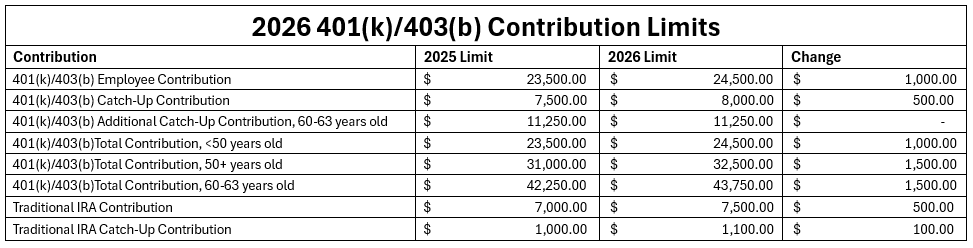

2026 401(k)/403(b) Contribution Limits

401(k) limit increases to $24,500 for 2026, IRA limit increases to $7,500

Oregon Paid Family Leave

Oregon Paid Family Leave requires the employer to calculate their employer size.

Per Oregon’s Secretary of State Website:

- “Employee count” means a headcount of all an employer’s employees, including employees in Oregon and all out-of-state employees, excluding the number of replacement employees hired to temporarily replace eligible employees during Paid Leave Oregon leave.

- “Large employer” means an employer whose employer size is 25 or more employees.

- “Small employer” means an employer whose employer size is less than 25 employees.

IMPORTANT: Employer size can be found in any of the current year Quarterly Tax documents, reviewing the Reconciliation Recap for “OR ER PLI”. If there is withholding under this line, you are listed as a large employer with us; if there is none, a small employer. Employer size changes must be reported to the State of Oregon Employment Department via Frances Online. This is done via the “Home” tab and “Report a Change in Business Status” from the Wages and Contributions section. Once this change has been completed, please forward any documentation to your Service Representative at support@paynw.com.

Below is a link that shows how to calculate your company’s total annual average employee count.

PaidLeave-Employer-Size-Instructions-EN.pdf

Washington Paid Family Leave

Starting Jan. 1, 2026:

- The premium rate will be 1.13%. The rate for 2025 is 0.92%.

- Employers will pay 28.57% of the total premium and employees will pay 71.43%

ACA Manager Service

For clients subscribed to our ACA Manager Service

Complete the 2025 ACA Year End Checklist by January 9th, 2026.

Please reference the ACA Guide and ACA Ongoing Maintenance document in readyConnect to assist you in completing the 2025 ACA Year End Checklist.

2025 ACA data must be reviewed and verified as accurate by January 9th, 2026. ACA data corrections needed after January 9th, 2026, will be subject to additional fees and will require amended returns.

Important Reminders:

- It is important you review ACA reports and data at the beginning of each month every month and review and resolve any Compliance Alerts or incorrect data in a timely manner.

- ACA data is calculated after the first of the month and is calculated based on current company ACA settings and employee information. If changes are made to company ACA settings or employee information after ACA data has auto calculated, you must manually recalculate ACA data to reflect the changes.

- You will be reviewing all 2025 data in January 2026.

Please prioritize the timely review of your data. Proactively addressing issues now will help alleviate constraints as we approach year-end. Please contact support@paynw.com if you have questions or need assistance.

January / February

- January 12th, 2026 to February 13th, 2026: PayNW will generate Employee Forms 1095-C and Employer Forms 1094-C. For employees who have not given Electronic Consent for Form 1095-C, paper forms will be printed and shipped before the IRS deadline of March 2nd, 2026.

March / April

- March 2nd, 2026: Forms 1095-C due to employees.

- March 31st, 2026: PayNW will generate and electronically transmit IRS AIR files by the IRS deadline of March 31st, 2026. State specific files, if required, will be electronically transmitted by the deadline established by each state.

- April 1st, 2026: ACA amended returns processing resumes.

For further information on IRS Form 1095-C furnishing and filing deadlines please see IRS 2025 Instructions for Forms 1094-C and 1095-C

2026 Minimum Wage Increases

As we approach the end of the year, it's important to be aware of the minimum wage changes scheduled for 2026. Each state sets its own minimum wage, and some cities have their own rates that may differ from the state minimum. It's your responsibility to stay updated on these rates and adjust accordingly.

Below is a chart of states with scheduled minimum wage increases effective January 1, 2026:

Please note: Please remember that local, county, and state minimum wages may vary and please ensure you are reviewing and using the correct wage rate for your employees.

It is your responsibility to ensure employee rates are updated. PayNW will not intentionally change employee’s rate of pay without a request from the employer. Please contact your service representative at support@paynw.com for further questions or assistance.

Rates may change at anytime and we provide the chart for informational purposes only. For up-to-date minimum wage information, please review the Department of Labor Website: DOL Minimum Wage or the State’s official website for updated information.

Protect Employees and Your Business From Payroll Fraud

It is crucial to ensure you and your employees are protected. We highly recommend voice verification for direct deposit changes.

It is of paramount importance that we maintain the highest level of security and integrity in our financial processes, particularly when it comes to employee direct deposit changes. To ensure that your employees’ hard-earned money remains safe and secure, we strongly encourage all our clients to voice verify if a direct deposit change is requested from an employee via email. This additional layer of security helps protect against unauthorized alterations, safeguarding your funds from potential identity theft or fraud.

Employers should check out these two blog posts on payroll fraud, and direct deposit scams.

NACHA Operating Rules Reminders 2025-26

Each client authorizing PayNW to create and transmit ACH transactions is required to comply with the NACHA Operating Rules as stated within the ACH Services Addendum between PayNW and the client. The National Automated Clearing House Association (NACHA) is the rule making body governing the ACH network; therefore, all participants of the ACH network must comply with these Rules.

NACHA rules specific to client originators include:

- Client agrees not to provide any payroll information or entries which violate the laws or regulations of the United States or of any state in which Client does business

- Client agrees to comply with all NACHA operating rules and guidelines

- PayNW and its Originating Depository Financial Institution (ODFI) maintain the right to audit NACHA compliance and to terminate or suspend the ACH relationship for noncompliance with NACHA operating rules and guidelines

Stay up-to-date with the most current NACHA Rules. The NACHA Rules are available online by setting up a user account. Visit the NACHA Rules Online by clicking here.

✨Thank you for your business. From all of us at PayNW,

we wish you and your family a happy and safe holiday season!✨

.png?width=533&height=300&name=ACA%20(300px).png)